Explore Market Depth with MT4 Trading Platform Tools

The mt4 trading platform is a widely favored tool among traders for its robust features, one of which is the ability to explore market depth—a critical component for understanding supply and demand dynamics in the financial markets.

Market depth, also known as the Level II Quotes, provides insight into the volume of buy and sell orders at various price levels beyond the best bid and ask prices. This transparency helps traders gauge market liquidity and anticipate potential price movements by observing how many orders are stacked on either side of the order book.

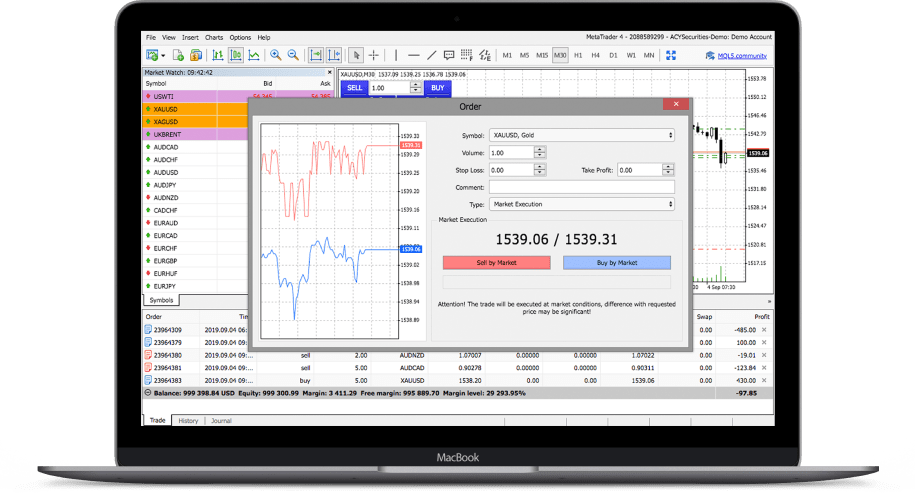

MT4 equips traders with access to market depth through its Market Depth window. This feature displays the available orders at different price points, showing not just the best available prices but also additional layers of buy and sell offers. By analyzing this data, traders can make more informed decisions about entry and exit points, especially in fast-moving or volatile markets.

Understanding market depth is particularly useful for executing large orders without causing significant price slippage. Traders can assess where liquidity clusters exist and plan their trades accordingly to minimize market impact.

Moreover, MT4’s market depth data integrates seamlessly with its real-time charting and order execution tools, allowing traders to respond quickly to changing market conditions. Whether you’re scalping small price movements or managing larger positions, having market depth information helps improve timing and strategy execution.

For more advanced users, MT4 supports customization through Expert Advisors (EAs) that can analyze market depth data to automate trading decisions based on supply and demand patterns.

In conclusion, the MT4 trading platform’s market depth tools offer valuable insights that go beyond simple price quotes. By exploring the layers of market liquidity, traders gain a deeper understanding of market dynamics, empowering them to trade smarter and more confidently.